Buying a new house is exciting. It’s also stressful and complicated. There are so many moving parts that can go wrong, but it doesn’t have to be that way! In this article, we’ll teach you everything you need to know about buying a new home from start to finish so you can enjoy the fun parts of owning your own place without worrying about all the things that could go wrong along the way.

Why buy a new house instead of renting?

Owning a home is a good investment.

Instead of paying rent, you can invest the money you save into your down payment and go from there. And when you buy a new house, it’s going to be more valuable once you sell it—and the appreciation on a new home is usually higher than that of an older one because it hasn’t been lived in for as long (meaning fewer wear-and-tear issues). After all, who wants to buy an old house with outdated plumbing and electrical wiring? Of course, if you plan on sticking around for a while then this isn’t important; but if not then new construction is definitely worth considering!

You can customize your living space however you like.

New houses come with built-in features like air conditioning or fireplaces—not all rentals do! You also have more control over how much space each room needs before deciding whether or not it works well enough for what needs doing in there (like sleeping/playing games).

How much can you afford?

You should be able to afford the house and the mortgage payments as well as taxes, insurance, maintenance, and repairs.

In addition to being able to pay for the house itself, you should be able to afford all of its other costs. These include property taxes (which vary depending on where you live), homeowner’s insurance (the cost of which can vary greatly based on location and size of your home), maintenance (which includes such things as mowing your lawn), and utilities (like water).

What is your credit score and how does it impact your home loan?

It is important to understand the importance of your credit score before you buy a home. A good score will help you qualify for better rates and lower fees. A bad one may lead to higher costs or even disqualification from some lenders. If you’re wondering where your scores stand, they’re easy to check online (try Credit Karma).

While there are many factors that go into determining whether or not someone qualifies for a mortgage loan, including their income and assets as well as their debt-to-income ratio, the most important factor is their credit score. The higher it is, the fewer risk banks see in lending them money; conversely, if your score isn’t high enough you may need more cash on hand in order to cover closing costs which can range anywhere between 2% and 10% of your loan amount (depending on where you live).

What kind of mortgage are you looking for?

There are three main types of mortgages: fixed, variable, and tracker.

Fixed mortgages remain at the same rate throughout their term. This is a good choice for someone who wants to keep their repayments the same each month and knows they won’t be selling or moving house within five years. If you think your circumstances will change during the length of your mortgage, then a fixed rate may not be right for you.

Variable rates move up and down with changes in CBN base rate – which happens every few months – so depending on where interest rates are going in relation to when your term ends, this could result in either cheaper or more expensive repayments over time compared with a fixed mortgage (see our guide on what interest-only mortgages are). However, because lenders usually offer more competitive deals when they’re trying to attract new business from borrowers who have never had their own home before (or haven’t done so for many years), if you’re buying for the first time then we’d recommend taking advantage of these introductory offers as long as there’s no penalty attached if you decide against moving over into one later on down the track (such as being charged extra fees).

What do you prefer, a townhouse or a single-family home?

You may be wondering whether you should buy a townhouse or a single-family home. Here are the pros and cons of each:

Townhouse Pros:

- You live in your own house, but it’s part of a small community with shared amenities.

- Maintenance costs are often lower because you don’t have to take care of the exterior of your home; this is typically done by an HOA (homeowner’s association).

- You have no yard work or landscaping chores to worry about, which makes for less hassle than owning a larger property would require.

Townhouse Cons:

- If all the units on your street are rented out, then you won’t have much interaction with neighbors unless someone moves away and leaves their place empty for a while—which can sometimes happen!

Single Family Home Pros:

You live in a house like everyone else on your block. It feels more private than living in an apartment building or condo unit because nobody is above or below you. There’s also plenty of room for kids to play outside without having to worry about them getting hurt from traffic passing by, which could happen in some neighborhoods where streets are narrow and cars often speed down them at high speeds.

Single Family Home Cons:

It’s harder to get approved for a mortgage if you have bad credit because lenders don’t want their money going towards something that will probably never be paid off in full. You also won’t benefit from any tax breaks that come with owning property.

If you prefer the privacy of a single-family home, then be prepared to sacrifice some convenience. Townhouses are typically located in a neighborhood where all the homes have similar layouts and features such as shared walls between units. This means that if one person lives above another, there’s less noise coming from upstairs than what might happen if they were separated by different floors.

How much money do you need to put down?

If you’re a first-time home buyer and have some money saved up, you can put down as much as 20% on your home. This will reduce the amount of money that you have to borrow, which will lower your monthly mortgage payments. If a 20% down payment isn’t possible for now, remember that this is just one way to save more cash over time. You can also look into saving in other ways such as decreasing your spending habits or investing in mutual funds or stocks.

Whether or not you plan on paying off your house quickly, putting down more than 10% is always recommended because it could help with getting approved for loans and saving time during each part of the home buying process (applying for mortgages and inspections).

Should you use a realtor when buying a house and how to find an experienced real estate agent?

On the real estate side of things, you’ll be working with a real estate agent. A realtor is a person who works as an intermediary between buyers and sellers of properties, as well as manages the entire transaction from beginning to end. Their job is to help find the right home for you at an affordable price while also making sure that your interests are protected throughout this process.

The first step to finding a good Realtor is to do some research on them beforehand so that you know what type of experience they have had in your area and what kinds of homes they specialize in selling or buying. Check their website or portfolio for examples of their work. You can also ask friends or family members who recently bought houses if they had any recommendations; sometimes word-of-mouth referrals can lead us down wonderful paths!

Once you’ve decided on someone who seems promising enough based on all these factors listed above; it’s time now to take action! Again though: keep in mind that this isn’t something which should happen overnight—it’s important not to rush into anything because doing so could cause more harm than good when trying new things out.”

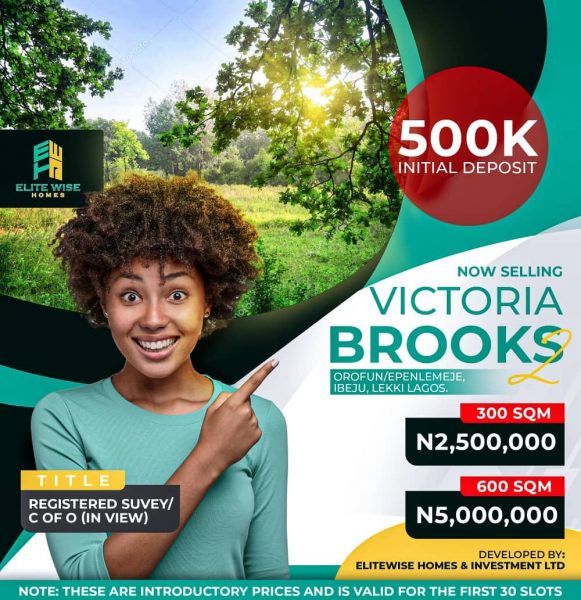

If you are looking for a reliable real estate agent with proven track records on Lagos Island, then we at Elitewise Homes Limited are here to help; having helped hundreds of clients within and outside Nigeria secure great real estate investments right in Lagos Island axis. Do reach out to us today

Do you want to buy a new house in the city or in the suburbs? Does the school district matter?

- How important is the school district?

- Do you want to buy a new house in the city or in the suburbs? Does the school district matter?

- The city or suburbs: what are your options and what are the pros and cons of each one?

You may also be wondering about whether it’s more exciting to live in a big city, or quieter and more peaceful to live outside of one. The answer will depend on your personality type, but there are other factors that should influence your decision as well. Here’s a breakdown of some important considerations when thinking about whether to buy a new house in the city or in suburbia:

When should you start looking for homes and what exactly does this entail?

The next question you’re probably asking yourself is when to start looking for homes. The answer to this question depends on your situation, but it’s generally best to begin looking as soon as possible. Your real estate agent can help you narrow down the list of potential homes by using their knowledge of the area and past clients’ experiences. The more information you have about what types of properties are available in your area, the easier it’ll be for them—and ultimately, you—to find one that fits all of your needs.

After finding a few houses that seem like a good fit for your needs and price range, it’s time to decide which one is right for you! But before getting into specifics about what makes each house unique (that comes later), there are some questions we need answers to; What exactly does this entail? How long should I look at houses before making my final decision? And how much time do I spend visiting each property while searching? As with any big decision in life (or business), there will always be pros and cons associated with every option available.

Is it possible to buy a new house with no money down if I am a first-time home buyer who has never owned property before?

If you’re a first-time home buyer and have never owned a property before, it is definitely possible to buy a home with no money down. In fact, there are several ways that you can do this.

Here are some of the most common scenarios in which homeowners may be able to purchase a new home with no money down:

- The homeowner has enough equity in their current home to transfer it into their name (also known as “cash out refinance”).

- The homeowner has been approved for an FHA loan and will use their personal savings account or retirement funds as part of their down payment requirements.

- The homeowner has been approved for an FHA loan and will use gifts from friends or family members toward their down payment requirements.

Things to keep in mind

- You need to make sure you have enough time to sell your home.

- You need to make sure you have enough time to close on the new home.

- You need to make sure you have enough time to move into the new house or apartment, as well as get used to living in a completely different area and neighborhood than what you’re used to before closing day arrives!

- When will we get the keys? Will they take care of all these things before they leave so we don’t have any problems with the moving company?

Conclusion

We hope this guide has been helpful in answering all your questions about buying a new house. It’s not an easy process, but there are many resources out there to help you along the way. If you’re ready to start searching for your dream home today, check out our list of top real estate agents who specialize in helping first-time home buyers locate the perfect property at an affordable price point!