Are you considering investing in real estate in Nigeria? Look no further than the Ibeju Lekki area of Lagos state. This rapidly developing region offers a multitude of benefits for investors and is quickly becoming one of the most sought-after areas to invest in. Here are just a few reasons why you should consider investing in Ibeju Lekki now:

Location, Location, Location:

Ibeju Lekki is strategically located on the outskirts of Lagos, providing easy access to the city center and other major areas. It is also home to the Lagos Free Trade Zone, Dangote Refinery, and the Lekki Deep Sea Port, which are all major drivers of economic growth in the region.

Rapid Development:

Ibeju Lekki is currently undergoing massive development and urbanization, making it a prime spot for real estate investments. The government has plans to develop the area into a major commercial and industrial hub, and private developers are also investing heavily in the region. The proposed 4th Mainland bridge that is to connect Lagos island to Ibeju Lekki which is in the pipeline, once completed, would further open up the area and increase its value and accessibility.

Unlock the potential for unparalleled growth with a strategic investment in Ibeju Lekki. Boasting an abundance of proposed international projects, this region is poised to take off and skyrocket your investment returns. Don’t be fooled by the popularity of Lekki Phase one, while it may have proximity to Victoria Island, it lacks the commercial centers and opportunities that Ibeju Lekki offers. Savvy investors have already recognized the potential in this area, now is the time to join them and secure your financial future.

Growing Tourism Industry:

The Ibeju Lekki area is home to several tourist attractions, including the beautiful beaches of Eleko and Akodo, as well as the Lekki Conservation Centre. As tourism continues to grow in Nigeria, investing in the hospitality industry in this area can be a lucrative opportunity.

Affordable Prices:

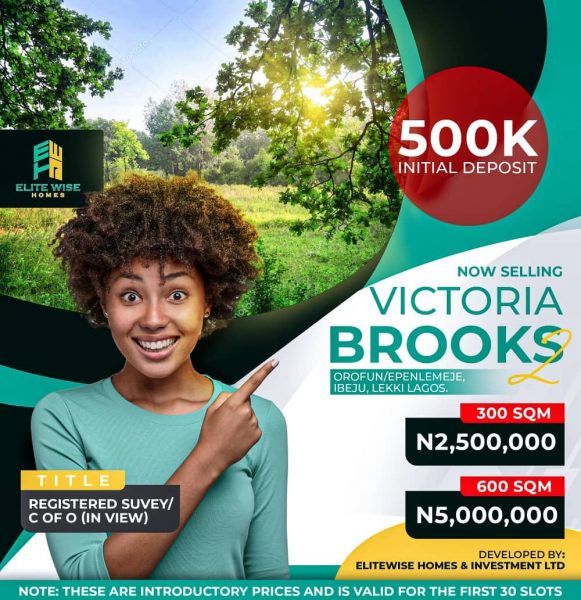

Real estate prices in Ibeju Lekki are still relatively affordable, making it a great option for first-time investors or those on a budget. As development and demand continue to increase, however, prices are also likely to rise, making it a great opportunity to get in on the ground floor.

Investing in waterfront land in Ibeju Lekki, especially Victoria Brooks Estate, is an opportunity that should not be missed. Back in 2001, waterfront land in Lekki Phase 1 could be purchased for as low as ₦10 million per 1000 sqm. But today, the same type of land is selling for ₦350 million or more. Can you imagine the financial gain if you had invested in waterfront land in Lekki Phase 1 back then?

Now, it’s time to look at the bigger picture and the potential for growth in Ibeju Lekki. The area is set to undergo massive development with proposed international projects and major players investing heavily in the region, making it an ideal location for real estate investment.

Currently, waterfront land in Ibeju Lekki is selling for as low as ₦3 million per plot and has the potential to appreciate to over ₦200 million in a few years.

Don’t miss out on this opportunity to secure your financial future and make history repeat itself by investing in Ibeju Lekki waterfront land. Our team of experts is available to guide you through the process and assist in securing the Global Certificate of Occupancy (C of O). Now is the time to invest and see your property and wealth grow. Contact us today to learn more about this limited-time offer.”

High ROI:

With the rapid development and economic growth in the area, investing in Ibeju Lekki can provide investors with a high return on investment. Many real estate experts predict that property values in the area will continue to increase in the coming years, making it a great long-term investment.

As the home of some of the most exciting multi-billion dollar projects in the region, such as the Dangote Refinery, Lekki Deep Sea Port, Lekki-Epe International Airport, and Lagos-Dubai Smart City, this area is a goldmine of opportunities. Imagine owning a piece of paradise with prestigious beach resorts such as La Campagne Tropicana Beach Resort and having access to world-class amenities such as the Lekki Golf Course. But that’s not all, with over 100 developing derivatives, you can be sure that your investment will always keep growing. Don’t miss out on this once-in-a-lifetime opportunity to join the ranks of smart investors and secure your financial future in Ibeju Lekki.

Conclusion

When it comes to investing in real estate, location is key. And Ibeju Lekki offers investors the perfect combination of location, development potential, and affordability. With the government’s ongoing development plans and the presence of major industrial and commercial players in the area, the potential for growth in this region is immense.

If you’re looking to invest in real estate in Nigeria, Ibeju Lekki should be at the top of your list. The time is now to take advantage of the opportunities this area has to offer.